The Process

Conservation Banking Process High Level Overview

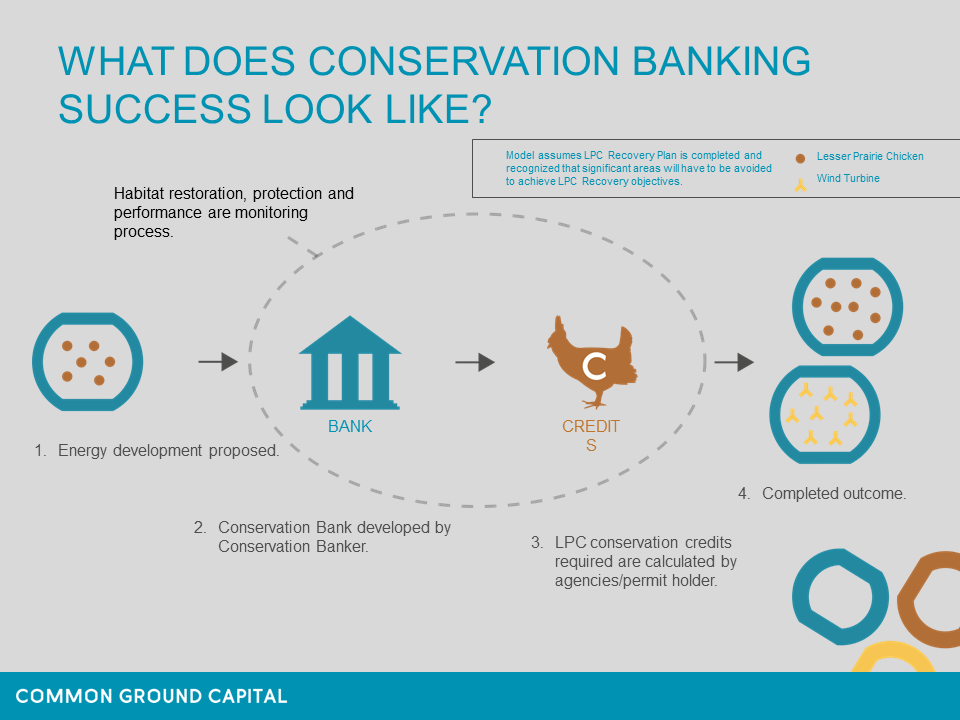

- Endangered Species Listing in place or wide-spread concern of a species status by industry, likely for species of interest or predictable voluntary market to avoid an ESA listing

- Energy or other development is proposed

- Conservation Bank developed by Conservation Banker using risk capital to develop credits in advance of the impacts

- Conservation credits required by developer are calculated by agencies/permit holder or program administrator

- Conservation banker sells credits to developer, appropriate ledger entries are made (permit holder and banker) and transaction is complete. Market-based conservation easement placed on the property along with a long-term management plan and endowment to fund the management plan and separate endowment to fund conservation easement put in place

- Conservation banker responsible for long term operation of the property to benefit the species in perpetuity

Landowner Process Summary

After a rigorous site selection search, Common Ground Capital (“CGC”) approaches the landowner to educate him/her on the conservation banking business model and ascertain interest. Terms are negotiated that result in the parties executing an agreement stipulating basic business terms and conditions that allow CGC to perform detailed site due diligence to confirm whether or not the site is indeed suitable to achieve the conservation objectives for the species of interest and meet the strict criteria required for US Fish & Wildlife Service (“USFWS”) approval. Assuming the site is acceptable, the conservation banker facilitates an introduction to prospective easement holders and the terms of the conservation agreement are negotiated (note: this is not a charitable tax deduction easement but terms and conditions are generally similar). CGC develops a detailed management plan and calculates the requisite financial assurances for the property and works with the USFWS to achieve conservation bank approval. The development process could take months or in some cases years. CGC bears the expense of all development activities. Once the conservation bank is approved and credits are released for sale by the USFWS, CGC has secured a customer or customers for the credits, then the credit transaction is consummated. At this point, the conservation easement is recorded at the county courthouse and the proceeds from the credit transaction are distributed to all parties which includes up front funding of the endowments. This process may replicate itself over multiple phases and years in some cases.

Credit Customer Process Summary

Typically, industry parties seeking to transfer liability from “incidental take” under the Endangered Species Act will seek a take permit under Sections 7 (federal nexus) or 10 (no federal nexus) or in the case of the Lesser Prairie Chicken under a Candidate Conservation Agreement with Assurances (“CCAA”) or Section 4(d) of the ESA. Should a species be listed enrollment in CCAA’s is not allowed after the listing effective date. In the case of Section 10, the most common method of achieving an incidental take permit (“ITP”) is via the creation of a Habitat Conservation Plan or “HCP”. In recent years the USFWS Regions 2 & 6 have strongly advocated for industry wide HCPs or CCAAs due to limited USFWS personnel resources and greater efficiencies enjoyed by all parties under industry wide permits. In rare cases, industry participants may also secure protection against incidental take via participating in a conservation plan approved by the USFWS under Section 4(d) of the ESA. From 2014-2016 this was the situation with the Western Association of Fish & Wildlife Agencies “WAFWA” Range Wide Plan “RWP” for the Lesser Prairie Chicken (note: 4(d) rule was eliminated as part of the 2016 de-listing and incidental take coverage does not presently exist for any industries outside of oil & gas). The timing of securing a path to achieve ITP relative the listing decision date is critical for industry participants in order to avoid project delay or potentially even work stoppage. If your company has not determined and secured the ability to achieve “take” at the time of a listing decision or after a listing decision’s effective date for an endangered species, project delay is a virtual certainty. Once a Section 7 or 10 permit is achieved or inclusion into a conservation plan under Section 4(d) or a CCAA, purchase of credits from conservation banks, or other approved mitigation options, can occur to transfer liability away from the project. Purchase of conservation bank credits is also an option under non ESA/voluntary market structures.